Some Known Facts About Okc Metro Group.

Table of ContentsOkc Metro Group for BeginnersThe smart Trick of Okc Metro Group That Nobody is Talking AboutWhat Does Okc Metro Group Do?How Okc Metro Group can Save You Time, Stress, and Money.7 Easy Facts About Okc Metro Group Shown

Period. Easy commutes to work are the crowning achievement for several home purchasers. Whether it's driving an auto, cycling, public transport, or perhaps walkability the commute time is a factor when selecting a location. In significant cities, if you purchase a house in an area where the city is mosting likely to develop a brand-new train quit you will see immediate admiration once that train appears.The ideal place for very easy transportation is near a significant highway or public transport. Neighborhood facilities have a direct influence on genuine estate prices in the location.

The 5-Minute Rule for Okc Metro Group

Customers want these features within a 5-10 min drive. If the place of the home you're acquiring is within a few miles of many of these facilities it will certainly help increase your residential property value. Several of the buyers I deal with directly make certain features a requirement in their home search.

Land is one point they aren't making even more of and this is a large reason why the place has such a huge effect on home values. If you're aiming to buy a property financial investment location is always mosting likely to be your leading priority because you're seeking gratitude and rentability.

In Raleigh, a few of the very best locations to buy property investments are locations with terrific locations where the actual estate prices don't necessarily show that. That's exactly how you experience maximum admiration, catch the neighborhood on its way up at first. This one can be a tough decision for lots of individuals, particularly those who are purchasing a home for the very first time.

Not known Details About Okc Metro Group

It's frequently a matter of perseverance discovering a home you will love in the best price array, so do not jump at a residence that is outside of your preferred place! You can constantly make updates and upgrades to a home, you can't update the area!

Whether that's school, job, or their favored hang-out spots, location is constantly an inspiring aspect for people. When you're buying a home ensure the place of the home is your top priority and you will discover yourself in a terrific situation. If you're getting a home, the very first point you must do is choose a place.

Location issues, also the place inside the area will have a large effect on your home's value. Once you pick the general location you want to live it makes feeling to start searching the details places within those areas. You want to acquire on the low end of the neighborhood's rate range since the various other homes in your community will certainly bring your value up.

Okc Metro Group Things To Know Before You Buy

People like water. If you remove anything from this short article, take this: The three most crucial variables when buying a home are location, location, and area. What are your ideas on the relevance of area in property? Allow us recognize in the comments section below!.

Routine maintenance and updates not only make the home preferred but additionally add to equity build-up. Broad economic elements, such as the overall health and wellness of the economic climate, passion rates, and work degrees, affect buyer demand. A thriving economic climate typically correlates with rising home costs, while economic downturns might see a dip.

The smart Trick of Okc Metro Group That Nobody is Talking About

Here's why it's crucial: Wide range Accumulation: As equity rises, so does your web well worth. Boosted Loaning Power: Lenders view home owners with considerable equity as less high-risk.

Wait for Market Admiration: In locations with climbing building values, simply holding onto a property can result in boosted equity. Stay Clear Of Taking on Additional Financial Obligation: Refrain from taking out 2nd home mortgages or home equity lines of credit rating unless it's purposefully beneficial.

Haley Joel Osment Then & Now!

Haley Joel Osment Then & Now! Amanda Bynes Then & Now!

Amanda Bynes Then & Now! Dylan and Cole Sprouse Then & Now!

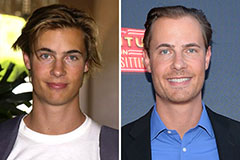

Dylan and Cole Sprouse Then & Now! Erik von Detten Then & Now!

Erik von Detten Then & Now! Rachael Leigh Cook Then & Now!

Rachael Leigh Cook Then & Now!